So you want to move to Spain and are ready for a big change. Would you like to start your own business in the land of sangria and tapas? Here are some facts and things you should know to get you started. Starting a business in Spain is not impossible!

Spain’s economy

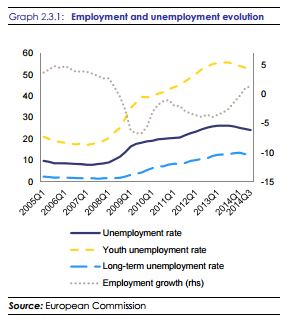

Spain had a 2016 Gross Domestic Product (GDP) of US$1.2 trillion and GDP per capita of US$26,528. Spain is the world’s 14th largest economy by nominal GDP and the 16th largest by purchasing power parity (PPP). The Spanish economy is 5th largest in the EU and the fourth largest in the Eurozone. It’s the world’s 12th biggest exporter. Despite the crisis, the unemployment rate is steadly decreasing, showing a positive economic evolution fo the Country.

Population: 48m

Public Debt/GDP: 98%

Unemployment: 24.5%

Inflation: -0.2%

Source: Forbes

Main industries

Textiles and apparel – Inditex

Food and beverages, esp. wine making – Chupa Chups, Freixenet SA

Metal and metal manufacturing – Acerinox

Chemicals – Uralita Group, Compania Logistica Hidrocarburos

Tourism – Iberia, Budgetplaces, Fiesta Hotels

Pharmaceuticals – Natra

As % of GDP

- Services 70.8

- Industry 26.0

- Agriculture 3.1

Starting a business in Spain

You can start a variety of businesses in Spain, including:

- Sole Trader (Empresario Individual or Autónomo)

- Limited liability company (Sociedad Limitada (SL) or Sociedad de Responsabilidad Limitada (SRL))

- Public Limited Company (Sociedad Anonima (SA))

- Partnership (Sociedad Civil)

- Joint enterprise (Comunidad de Bienes (CB))

- New Enterprise Limited Company (Sociedad Limitada Nueva Empresa (SLNE)

Before starting a business in Spain, foreigners must apply for a NIE or tax ID number. To do this visit a national police station (Comisaria) with a foreigner’s office (Oficina de Extranjeros)

Required documents:

- An application form Solicitud de Número de Identidad de Extranjero (NIE) y Certificados (form EX-15)

- Payment receipt stamped by the bank

- ID card or valid passport and a photocopy

- Two passport photographs

Registering your business

- Register your company’s name online at the Central Commercial Registry (Registro Mercantil Central) English version available

- Apply for your company tax identification code (CIF) at the tax office (Delegación de Hacienda). To save time, download the 036 form here. English version available

- Deposit capital into the company’s bank account. A minimum of €3,000 must be deposited at this stage (how much depends on the type of business)

- With the name registry certificate, CIF and capital deposit receipt you can sign the deed of incorporation before a Spanish notary and be registered as company director. Find your local notary here (Spanish)

- Transfer 1% of company capital (transfer tax) at the tax office where the company is located.

- Now you’re able to register the company at the Corporate Registry (Registro Mercantil)

- Your company is now liable for the Spanish Tax on Economic Activity, so you should register the company at the tax office (Delegación de Hacienda). The office will ask for the details of your business: the nature of the company, start date of trading, where the business is physically located etc.

- Register your company at the Social Security General Treasureship (Tesoreria General de la Seguridad Social)

- Acquire a ‘libro de matrícula’ – to log personnel registration and visits from the labour office (Inspección de trabajo)

- Commencement of your company’s opening needs to be filed at the Regional Work Authorities Office (Dirección Provincial de Trabajo)

- Apply for the opening license at the Spanish Town Council (Ayuntamiento). Make sure to take the map of the company premises, its address, company description and receipt of local tax payment.

- As a foreigner, you’ll need to declare the use of foreign investment capital at the Spanish Investments Register (Registro de Inversiones) of the Tax and Economy Ministry (Ministerio de Economía y Hacienda).

Business tax in Spain

Spain’s tax year follows that of the ordinary calendar year.

As of January 2015, a new lower tax rate has been introduced for new companies. The rate is 15% and applies for the first two years in which a company achieves a taxable profit.

Spanish business tax rates

National business tax (Impuesto de Sociedades) is payable by all companies, including non-resident companies in Spain. The standard rate is 30% but differs depending on the size and turnover of a company:

- Small-to-medium i.e. net turnover of less than €10m a year pay 25% tax rate on the first €300,000 profit and 30% over that amount.

- VAT (IVA, Impuesto Sobre el Valor Anadido). IVA isn’t a tax incurred by you but by your customers for the use or purchase of your products or services. However, it’s your responsibility to collect the tax and pay it to the Spanish government. IVA ranges from 4% – 21%

Comparison by country of various influencers on business. Scale runs from 1-100, with 1 being the best score.

Already started your own company in Spain? Leave your advice and experiences in the comments!

Everything is very open with a really clear clarification of

the challenges. It was definitely informative.

Your website is very useful. Thanks for sharing!